Navigating mandatory B2B e-invoicing: key insights

Many of our clients have recently inquired about the new mandatory B2B electronic invoicing requirement. Therefore, we have decided to provide you with a detailed analysis and practical advice to help you smoothly prepare for this transition.

An unavoidable shift for businesses

As you may already be aware, on February 2, 2024, the Belgian Parliament approved a legislative amendment to the VAT Code, making electronic invoicing mandatory for B2B transactions starting from January 1, 2026.

Currently, electronic invoicing is already the standard for invoices sent to public administrations. From January 1, 2026, all businesses and VAT-registered individuals will need to comply with the regulations on invoice digitalization via the Peppol network.

No phased introduction: e-invoicing will become the standard for all B2B transactions starting January 1, 2026.

What is an "electronic invoice" under this new law?

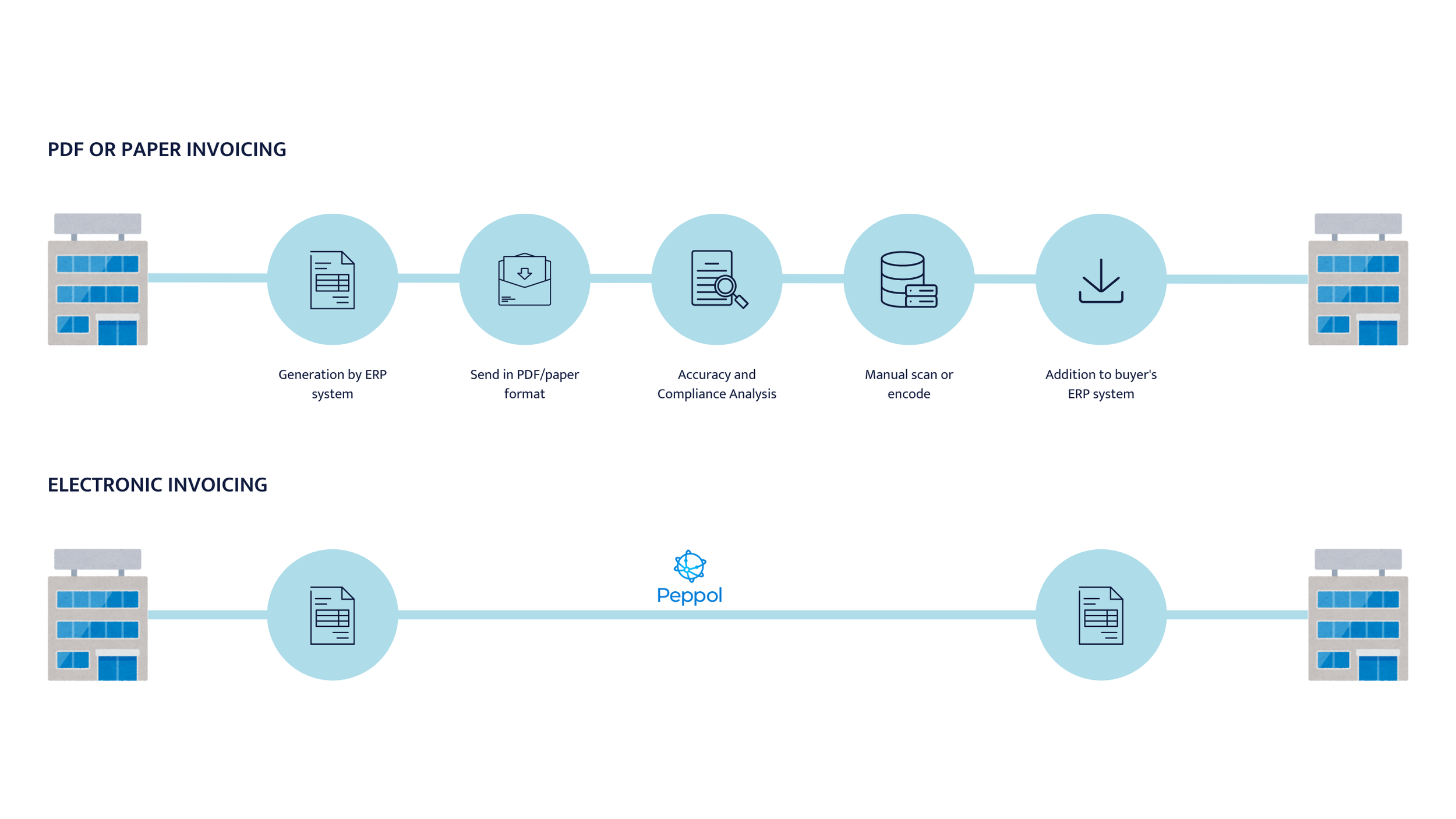

According to the new legislation, an electronic invoice must be issued, transmitted, and received in a structured electronic format that allows for automatic processing without manual intervention, ensuring direct exchange between financial systems ("machine to machine").

Until the end of 2025, you may continue sending invoices in PDF format or by mail. However, starting in 2026, the law requires that structured electronic invoices be issued in a specific format, namely the PEPPOL-BIS format, through which structured electronic invoices are systematically sent via the PEPPOL (“Pan-European Public Procurement Online”) network, a secure and regulated network for electronic document exchange.

Within minutes, new invoices will be sent directly to the recipient's accounting system.

When must an electronic invoice be issued?

The issuance of electronic invoices will be mandatory in a B2B context, but only between Belgian VAT-registered taxpayers.

In practice, three conditions must be met simultaneously for the obligation to issue an electronic invoice to apply:

Invoice Issuer: The issuer must be established in Belgium (for VAT purposes) and registered for VAT.

Invoice Recipient: The recipient must also be VAT-registered in Belgium and have provided their VAT number to their supplier, regardless of whether they are a foreign entity.

Invoice Subject: The invoiced delivery must be subject to VAT in Belgium and not exempt under Article 44 of the VAT Code.

The digitalization of cross-border invoices within the EU will only begin in 2028.

Obligation to receive and obligation to accept

It goes without saying that this obligation to issue an invoice can only be practically implemented if the recipient of such an invoice is also capable of receiving the invoice issued in this format. Therefore, as a logical corollary to the obligation to issue electronic invoices, the law requires that VAT-registered entities must take the necessary measures to be technically able to receive structured electronic invoices and cannot refuse them.

The law also provides that VAT-registered entities that do not have the necessary IT capabilities can fulfil the obligation to receive invoices through a third party, such as the public platform HERMES.

Why this new requirement?

One of the major goals of mandatory electronic invoicing is to reduce VAT fraud.

The VAT gap, which is the difference between theoretical and actual VAT revenues, is often due to fraud or reporting errors. By automating and standardizing invoicing processes, governments can better track transactions and more easily detect fraud.

However, the introduction of electronic invoicing across Europe also aims to harmonize business and tax practices among member states. This contributes to deeper economic integration within the European Union and the modernization of national tax systems.

The transition to a single standard is crucial to ensure the consistency and reliability of commercial exchanges while reducing errors and increasing transaction security.

Opportunities to seize

Although this transition may seem challenging, it brings numerous benefits:

-

In the medium term, automating invoicing reduces the time and expenses associated with managing it. Additionally, for incoming invoices, they are directly integrated into accounting software without the need for OCR software.

-

Electronic invoices are processed more quickly by buyers and suppliers, which speeds up payments. Businesses benefit from better cash flow when they are paid promptly. Similarly, for incoming invoices, paying quickly yourself helps avoid costs associated with late payments.

-

Beyond the security provided by encryption technologies in the Peppol standard, electronic invoicing eliminates the risk of manual entry errors and enables better traceability of transactions.

-

By invoicing electronically, businesses save paper and ink, making them more environmentally friendly.

What are the risks of non-compliance?

Failing to comply with this obligation can lead to significant financial consequences.

Although no specific sanctions are outlined for non-compliance, if an electronic invoice is required but not issued, the Belgian VAT authorities may argue that no invoice was issued at all. As a result, the supplier could face a fine of up to €5,000 per invoice. Additionally, the customer would be denied the right to reclaim the VAT on that invoice and could face a penalty of 5 to 10% of the VAT due, along with late payment interest of 8% per year.

Tax Support Measures

Additionally, to support this transition and minimize the financial impact of the necessary IT developments that this new obligation may entail, the government has introduced tax support measures.

The law provides that the deduction for investment expenses is increased to 20%, making the cost of electronic invoicing 120% deductible.

This increase applies to all expenses and investments related to electronic invoicing, including:

Digital investments in areas such as invoicing, customer relationship management, e-commerce, and cybersecurity,

Expenses incurred for invoicing software that enables structured electronic invoicing, including periodic subscription fees,

And consultancy fees—such as the costs of accounting firms and tax advisors—incurred in the operationalization of electronic invoicing.

This measure already applies to investments made from January 1, 2025 (and up to and including the 2027 tax period), making it easier for companies to comply with their e-invoicing obligations from 2026.

Get Ready Now!

Depending on your company’s level of digital maturity, compliance and the transition to electronic invoicing can take time.

Discover our 4 steps for a seamless transition to 100% digital invoicing.

1️⃣ Conduct an internal audit

Analyze your current invoicing systems to identify any gaps in meeting legal requirements. Reviewing both incoming (supplier) and outgoing (customer) invoicing flows allows you to see how these exchanges are currently handled and where improvements can be made. Check whether your existing systems can integrate with electronic invoicing software or if an upgrade is needed.

2️⃣ Select software or a service provider

Choose an electronic invoicing solution that meets your company's specific needs and complies with current regulations. Ensure that the solution is compatible with your existing systems and capable of handling the expected workload.

In recent years, numerous invoicing software programs have emerged on the market, particularly aimed at businesses with low invoice volumes. Many of these programs are free up to a certain volume or operate with reduced "pay-as-you-go" pricing. Regardless of the solution chosen, we recommend considering both the sending and receiving capabilities when selecting an appropriate package.

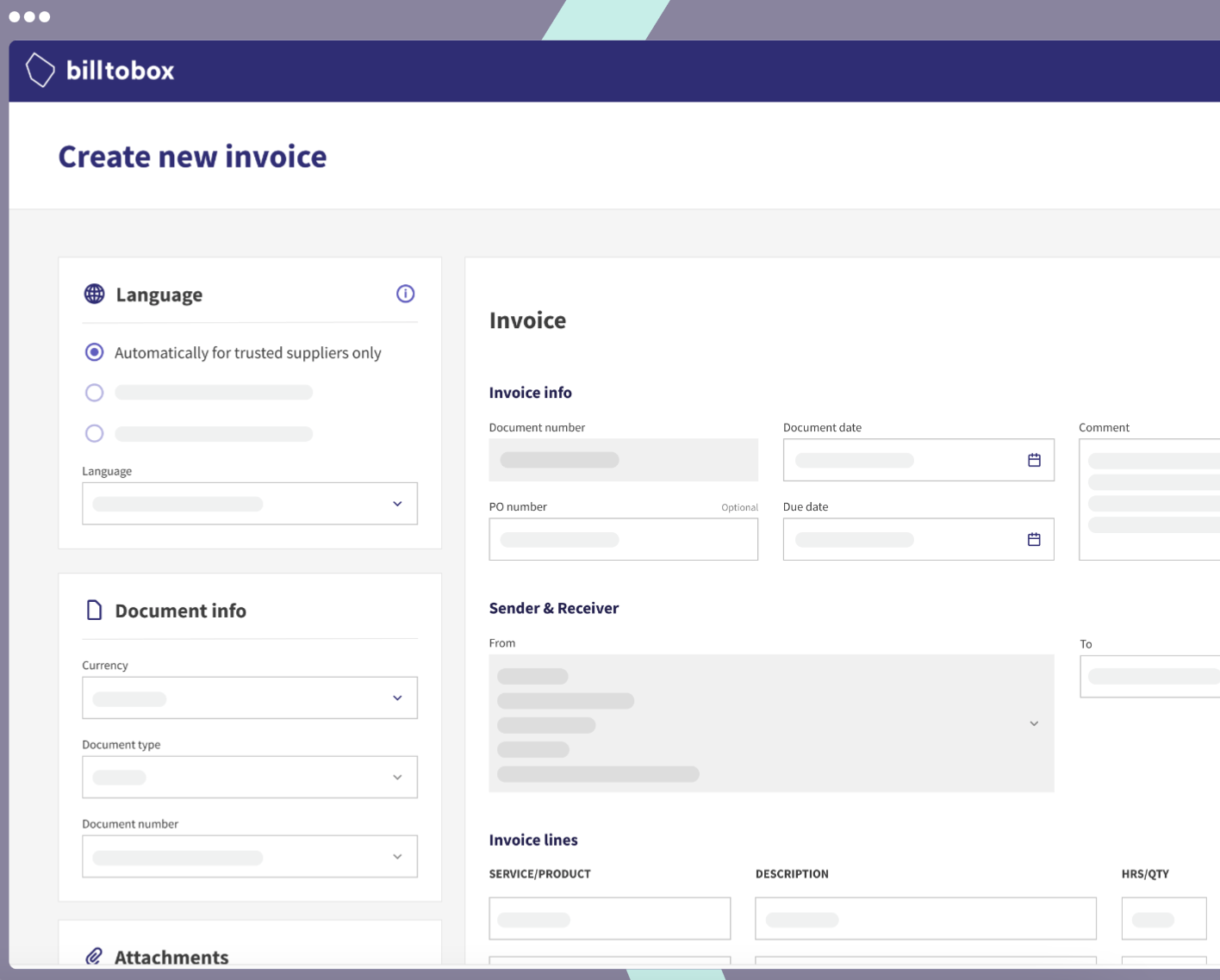

Our recommended software: Billtobox

Billtobox is the digital link between entrepreneurs and their accountants. With Billtobox, you can create and send outgoing invoices, get paid, and maintain a comprehensive overview of your finances. This service offers advanced features for invoice management and streamlines your financial processes.

It’s also the tool recommended by the ITAA (Institute of Tax Advisors and Accountants).

Considering adopting Billtobox?

3️⃣ Start with supplier invoices

Digitizing your supplier invoices offers an immediate productivity boost and prepares you for the first step of the reform, which is the obligation to accept invoices in electronic format.

4️⃣ Deploy Gradually

Roll out electronic invoicing gradually, starting with a small sample of clients or transactions. This approach allows you to quickly identify and resolve any potential issues.